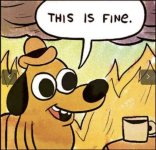

I get it - there's people that can't walk & chew gum at the same time. But as a legit business, why would you deceptively lend someone money you damn well know they can't pay back based on their income? It used to be that they looked at your income & lent accordingly. Not in the years leading up to 2008. They gamed their own system and did this on purpose, bundled these turds together, and sold them to someone else. That someone else knew these were turds, but they in turn sold these to yet another party.

Edit: Now credit card dept is a whole different ball of wax. That's where the paste-eaters get themselves into massive debt then try to declare bankruptcy, because hey, the billboards and commercials say I can get out of debt just by snapping my fingers.